September Dogs Of The Dow: Chevron's 3.5% Is Better Than 3M's 5.1% (NYSE:CVX) – Seeking Alpha

GlobalP/iStock via Getty Images

GlobalP/iStock via Getty Images

The Dogs of the Dow strategy is so well-known and popular for good reasons. It is systematic and simple. The method provides a systematic process to pick the best combination of value and quality among 30 blue-chip stocks in the Dow index. The strategy involves a few simple steps as detailed by this website:

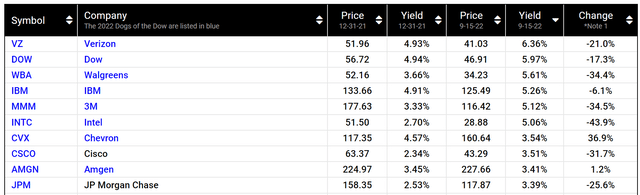

And above all, it really works (past performances are provided in section 2 if you cannot wait). And I am willing to bet my money (both figurative and literally) on the method that it will keep working. Because it is based on the timeless concept of being valued-centric and disciplined. And the Dogs of the Dow list for September is shown below. As you can see, our main topic for today, the 3M Company (NYSE:MMM) and Chevron (NYSE:CVX) are currently the 5th and 7th highest ranked picks. They are indeed both attractive to income-oriented investors with their dividend champion status and high current yields.

Source: dogsofthedow.com

Source: dogsofthedow.com

However, occasionally, special events call for a closer examination (like the case with General Electric a few years ago when it made the list). And I feel this is one of the occasions when you should not blindly follow the list. Once we look beyond the dividend yield on the surface, you will see at least two reasons to prefer CVX over MMM despite the lower yield. These reasons are summarized here, and the remainder of the article will detail these considerations.

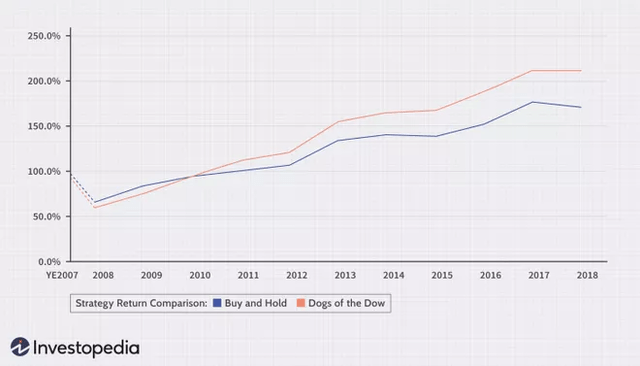

As aforementioned, the method has been really effective. The below plot shows the performance of this method since 2007. According to Investopedia:

The chart compares the strategy to simply holding the Dow Jones Industrial index (“DJIA”). As seen, the strategy lagged the DJIA after the 2008 crash till 2010. Then it recovered and has been outperforming DJIA consistently since then. According to Investopedia.com, $10,000 invested in DJIA from the beginning of 2008 would grow to $17,350 in 2018. While the Dogs of the Dow strategy would have grown to $21,420.

Source: Investopedia.com

Source: Investopedia.com

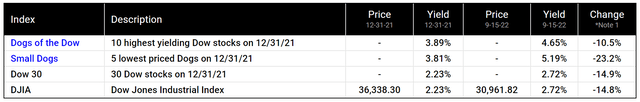

In case you are wondering if it performs also under the volatile conditions we have been experiencing lately, the answer is yes, as you can see from the chart below. If you have picked the Dogs of the Dow at the beginning of this year, you would have unfortunately lost 10.5% by now. However, the Dow 30 index itself lost more than 14.9%. So the dogs are still outperforming relative to the index.

With the overall background, now let’s examine CVX and MMM more closely.

Source: dogsofthedow.com

Source: dogsofthedow.com

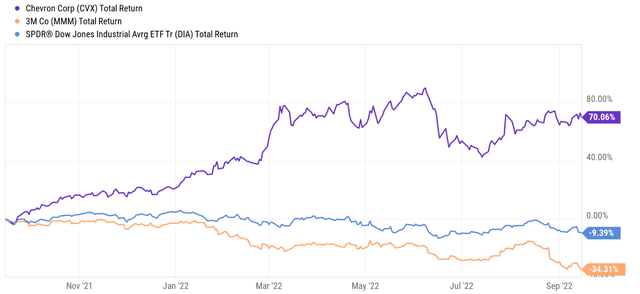

Now back to CVX and MMM. As you can see from the following chart, CVX has been outperforming remarkably in the past year against a backdrop of an overall market correction. The fundamental reasons are argued in my earlier articles (compressed oil price, natural gas shortage, et al), and these reasons are still valid in my mind. CVX delivered a positive total return of more than 70% in the past year. In contrast, the DIJA index, as represented by the SPDR Dow Jones Industrial Average ETF (DIA), suffered a loss of more than 9.3%. And MMM performed even worse, suffering a total loss of more than 34%.

Source: Seeking Alpha data

Source: Seeking Alpha data

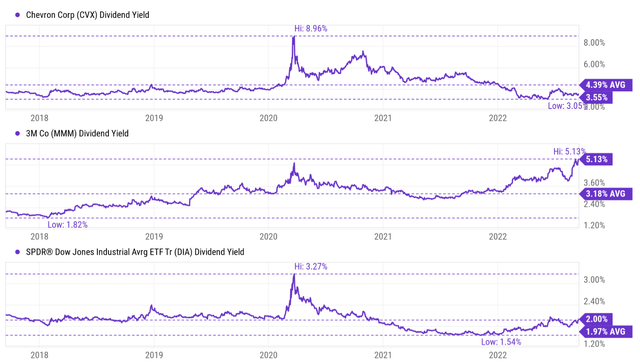

In terms of dividend yields, MMM indeed looks more attractive than CVX. The dividend for CVX is 3.55% as seen, substantially lower than MMM’s 5.13%.

Furthermore, to put it under historical perspective, CVX dividend yield has fluctuated in the past 10 years between 3.05% and 8.96% with an average of 4.39%. Its current dividend yield of 3.55% is lower than its historical average by almost 40% in relative terms. For MMM, its dividend yield has fluctuated in the past 10 years between 1.82% and 5.13%, with an average of 3.18%. Its current dividend yield of 5.13% is higher than its historical average by almost 60% in relative terms. To provide another reference point, the DIA itself is about fairly valued now after the recent corrections. Its dividend yield fluctuated in the past 10 years between 1.54% and 3.27%, with an average of 1.97%. And it is currently yielding 2%, slightly above its historical average.

So, on the surface, CVX is not cheap while MMM is for sale at a large discount. However, note that the average yield for CVX has been substantially biased by extremely high yield during 2020 and 2021. And also, as to be detailed next, its dividend yields also underestimate its total shareholder yield potential because a substantial fraction of its yield would come from share repurchases going forward.

Source: Seeking Alpha data

Source: Seeking Alpha data

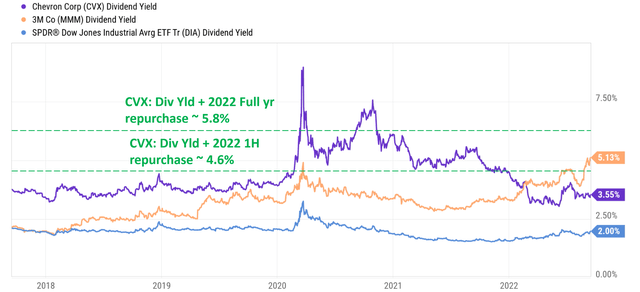

For long-term investors, total shareholder yield, rather than dividend yield, is what ultimately matters. When the total shareholder yield is considered, the picture totally changes as shown below. In the next few years, a significant part of CVX’s total shareholder yield would come from share repurchases (which is totally ignored in the above dividend yield comparison). While in contrast, MMM share repurchases are in suspension as announced by its CFO Monish Patolawala during the latest ER (abridged and emphases added by me):

During the quarter, we returned $848 million to shareholders through cash dividends. As we have communicated previously, share repurchases remained suspended in Q2 due to the pending food safety separation. We intend to complete the separation through a split-off with the closing date of September 1, subject to Neogen shareholder approval and other customary closing conditions.

To wit, my estimate of CVX’s buyback yield is about 1.1% for the H1 of 2022 and 2.4% for the full-year 2022. The details of these estimates are provided in our earlier article and the key assumptions are quoted below. As a result, CVX’s total shareholder holder is about 4.6% (3.5% dividend yield + 1.1% buyback yield) for H1 of 2022. And for the full-year 2022, it could reach almost 5.8%, substantially higher than MMM’s total shareholder yield, which would be 5.13%, the same as its dividend due to the suspension of buybacks.

CVX spent $1.3 billion on share repurchases during the first quarter of 2022. It plans to spend another $2.5 billion on share repurchases in the second quarter of 2022. As a result, at its current market cap, these share repurchases during the first half of 2022 will add about 1.1% of additional yield to the total shareholder yield. So just considering its current dividend and 2022 1H share repurchases would bring its total shareholder yield to 4.6% already. If the repurchases continue at the same pace for the remainder of the year, it would provide a total shareholder yield of around 5.8%.

Source: Author based on Seeking Alpha data

Source: Author based on Seeking Alpha data

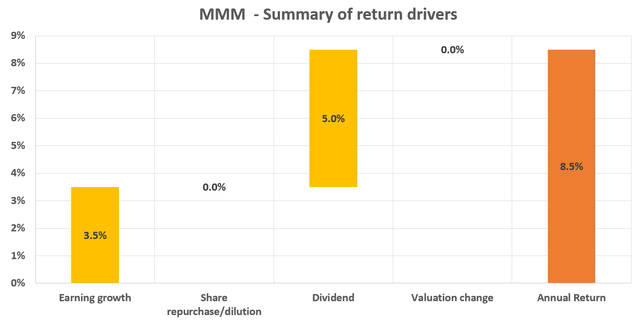

Onto valuation and projected returns. There is little doubt that MMM is currently at a discount relative to its historical valuations. The extent of the discount depends on the metric you choose. As aforementioned, its dividend yield indicates a large discount of 60%. In terms of PE multiple (FW PE is about 15.6x according to SA), the discount is smaller, about 16% compared to the historical average of 18.5x. However, I do not expect a valuation expansion until the lawsuits surrounding its earplugs become resolved, which could take years or even a decade. Based on these considerations, the chart below summarizes my return projections. More specifically, I am projecting about 8.5% total return per annum in the next 3~5 years consisting of:

Source: Author based on Seeking Alpha data

Source: Author based on Seeking Alpha data

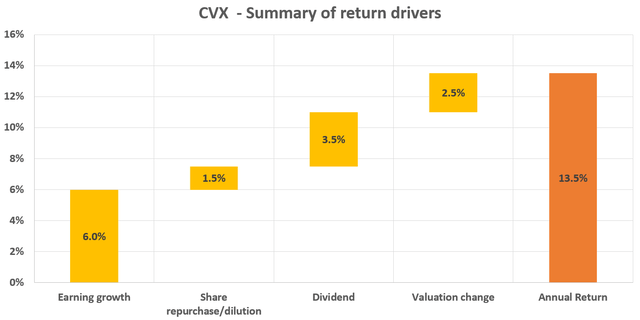

In contrast, the picture for CVX is much rosier as seen below. As detailed in my earlier article, I think a growth rate of 6% is easily achievable. I expect its ROCE to stabilize at 20% and the reinvestment rates to be about 15%. Under this combination, the long-term organic growth rate will be about 3% per annum (20% ROCE x 15% reinvestment rates). Then I think it is very safe and conservative to add an inflation escalator of 3%. I think the oil and natural gas prices will very likely rise more than 3% per year in the next few years, as repeatedly argued in my previous articles. All told, I am projecting about 13.5% annual total returns in the next 3~5 years consisting of:

Source: Author based on Seeking Alpha data

Source: Author based on Seeking Alpha data

First, both businesses face substantial macroscopic headwinds in the near term such as supply-chain issues, rising labor costs, and the possibility of a recession. However, I see the business-specific risks much higher for MMM than for CVX. A big part of current inflation is due to fuel costs per the latest data from Bureau of Labor Statistics. And MMM will be hurt by high fuel costs while CVX will benefit. The lawsuits surrounding its earplug are a large uncertainty that is hard to estimate (this source estimated that the potential losses could reach $100 billion). For CVX, the stock is inherently more volatile due to commodity prices. If you recall from an earlier chart, its dividend yield fluctuated by almost 3x, between as low as about 3.05% to as high as 9.96% in the past decade. In the longer term, climate and environmental concerns are risks for CVX (and other big oil stocks as well). CVX could be negatively impacted by its own lawsuits, government regulations, and tax laws.

To conclude, MMM and CVX are currently the 5th and 7th highest yielding stocks in the Dogs of the Dow list. However, I feel that this is one of the special occasions where you should take a closer look instead of blindly following the list. It is true that CVX’s dividend yield is lower than MMM (by quite a bit). However, it actually offers a higher total shareholder yield due to generous buybacks and higher total return potential than MMM.

Join Envision Early Retirement to navigate such a turbulent market.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.

This article was written by

** Disclosure** I am associated with Envision Research

I am an economist by training, with a focus on financial economics. After I completed my PhD, I have been professionally working as a quantitative modeler, with a focus on the mortgage market, commercial market, and the banking industry for more than a decade. And at the same time, I have been managing several investment accounts for my family for the past 15 years, going through two market crashes and an incredible long bull market in between.

My writing interests are mostly asset allocation and ETFs, particularly those related to the overall market, bonds, banking and financial sectors, and housing markets. I have been a long time SA reader, and am excited to become a more active participator in this wonderful community!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.